A call butterfly is a fully hedged options trade …

… with an upwards bias.

It consists of four call options.

2 buys…

…and 2 sells.

One can play any overtly rising underlying with the call butterfly, without batting an eyelid.

Why?

Firstly, and most importantly, one is fully hedged.

Meaning?

At first look, the call butterfly seems market neutral as far as basic mathematics is concerned, that is +1, -2, +1, net net 0.

So, net net, one isn’t looking at a large loss if one is wrong.

When is one wrong here?

If the underlying doesn’t move, or if it falls, in the stipulated period, then one is wrong,…

…and one will incur a loss.

However, the loss will be relatively small, because of the call butterfly’s structural market neutrality.

And that’s magic, at least to my ears.

Method to enter anything flying off the handle with the chance of a small loss?

Will take it.

Then, also very importantly, the margin requirement is relatively less, when one uses the following chronology.

One executes the buys first.

Then come the sells.

Upon the upholding of this chronology, the market regulator is lenient with one on margin requirement, as long as the trade-construct is market neutral.

Typically, for one butterfly, total margin requirement is in the range of 50 to a 100k.

Now let’s talk about what one is looking to make.

5k per single-lot trade-construct, if it’s fast, as in execute today, square-off tomorrow, or even intraday, if expiry is close.

10k if slow, as in 7 to 10 days.

If the butterfly is not yielding because the underlying is not moving, then one is looking to exit, typically with a minus of under 3k.

Just do the math. Numbers are great.

What kind of a maximum loss are we looking at, if things go badly wrong, as in if the underlying sinks?

5k to 10k.

Can the loss be more?

If the trade construct is such that the butterfly can even give 40 odd k till expiry, one could even be looking at a max loss of about 15k too.

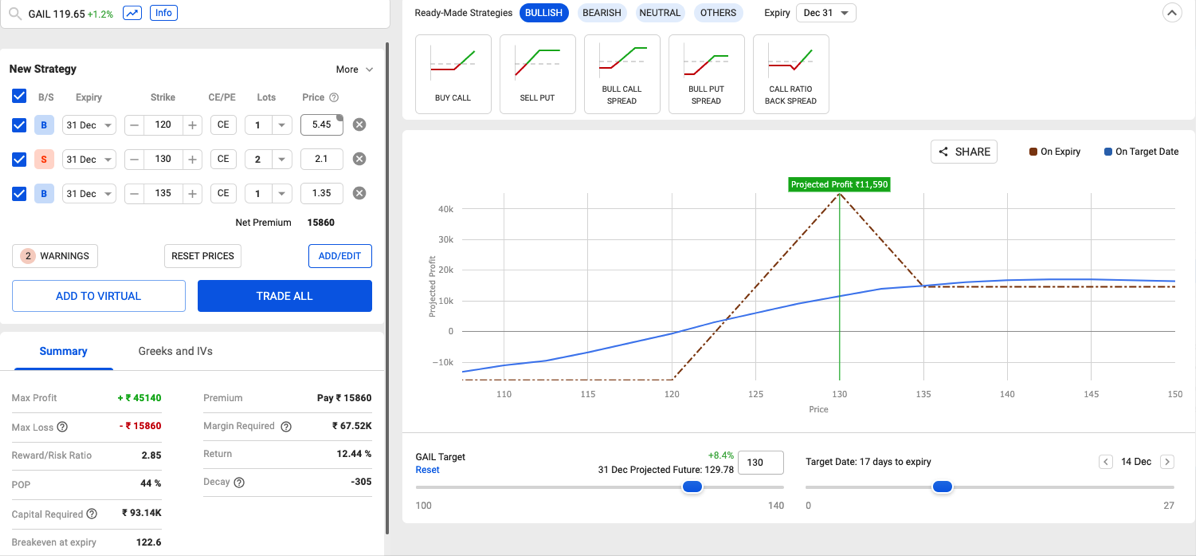

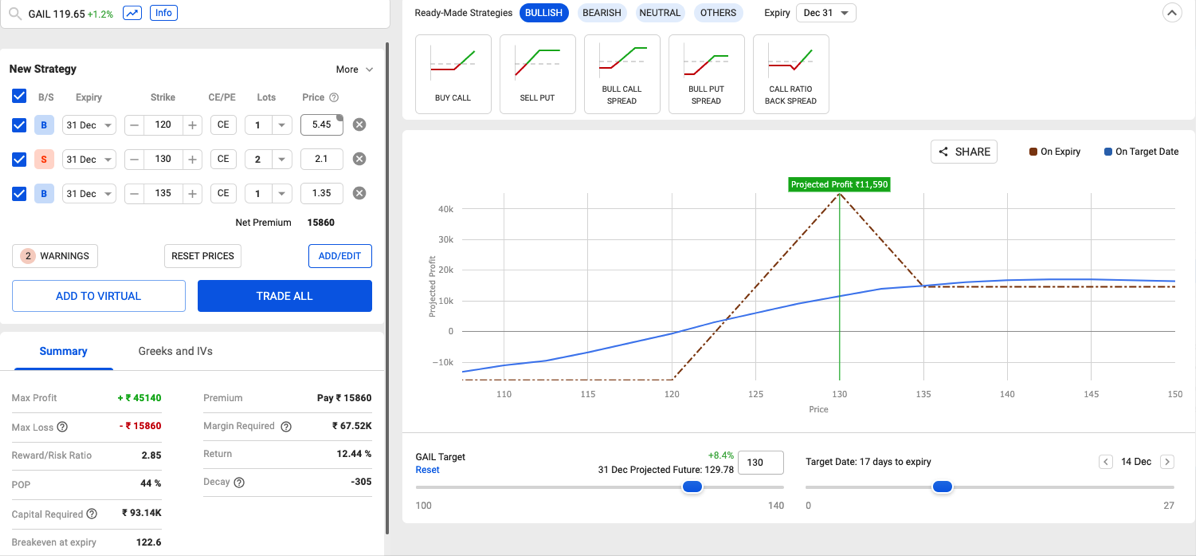

Here’s an example of a call butterfly trade that can lose around 15-16k, but has the potential to make upto around 45k till expiry. The graphical representation is courtesy Sensibull.

I mean, it’s all still acceptable.

Tweaks?

Let’s say one is losing.

Sells will be in biggish plus.

Square-off the sells. Yeah, break the hedge.

Margin gets returned. Premium pocketed.

Buys are exposed, though.

They are losing big.

With some time to go till expiry, if the underlying goes back up, the buys gain.

What one makes off the trade is proportional to how much the underlying goes up.

It’s riskier. Correspondingly, profit potential is higher.

Money risked here will be up to double of the fully hedged version of the trade, and one could lose this amount if the underlying does not come back up appropriately and in time. Pocketed premium of the squared-off sells softens the hit.

Therefore, it makes more sense to pull this tweak with at least ten days to go before expiry, giving the underlying time to recoup.

Got another tweak.

This one’s intraday, though.

Underlying’s on a roll, and you want to make the most possible off the opportunity.

Square-off the sells at a huge loss.

Let the buys, which are winning big, run for some part of the day.

Chances of them yielding more are very high.

Square-off the buys before close of trade.

If the underlying promises to close on a high, square-off the out-of-the-money buy before close of trade, and take the in-the-money buy overnight.

Risky, though.

You could lessen your risk, and increase your chances of taking most profits off the table by squaring off the in-the-money buy and taking the out-of-the-money buy overnight.

Square-off the overnight buy next morning on a high, or wherever feasible.

With this particular tweak, the trade becomes somewhat more like a lesser exposed futures transaction, at least for some time, after the hedge is broken.

There’s another thing one can do with the call butterfly.

One can adjust it as per the level of perceived bullishness.

If -1 and -1 are set at the same level, one trades for averagely perceived bullishness.

If one -1 is closer to the lower +1, and the other -1 is above this first -1, then one trades for below average perceived bullishness.

If one -1 is closer to the upper +1, and the other -1 is below this first -1, then one trades for above average perceived bullishness.

Anything else worth mentioning?

Volume. Need it.

Bid-ask spread needs to be narrow.

Scaling up needs to correspond to one’s risk-profile, requirement, temperament and acumen.

One can make it an income thing by scaling up, during bull runs, or generally, just in case an up move is tending to pan out.

One can make the call butterfly do a lot of things.

It’s a very versatile trade to play a rising market, with low risk and low capital requirement.

Happy trading!

🙂

Would you like to share this post?